Visma.net ERP

About basic models for a multi-branch organisation

In today’s global environment, an organisation may have a hierarchic structure of

subsidiaries or branches and complex multi-level reporting requirements.

Such an

organisation may need tools for easy data consolidation, as well as better

visibility into various layers of financial operations within the organisation.

Visma.net ERP supports multi-branch functionality and provides multiple basic one-level and two-level models, outlined in the topics below, for implementing the most typical organisational structures. For more complex organisations, such models may be combined to implement any structure.

Choosing the model (or combination of models) that suits your organisation best is an important decision that must be made before you start implementing Visma.net ERP.

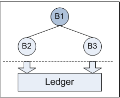

With model 1, shown in the illustration below, the organisation, which is a single

legal entity, consists of two branches (or locations), each branch representing a

company office.

Transactions are posted to these branches.

To implement this model in Visma.net ERP, you have to create an additional branch that will represent the legal entity. You also have to have one posting ledger of the Actual type.

You need to specify the additional branch as the consolidating branch for the posting

ledger by using the Consolidation branch column in the Ledgers (GL201500) window.

The consolidating branch is used

only in Window 1099-MISC and tax reports to represent the legal entity.

No

transactions are posted to the consolidating branch.

To be able to use automatic generation of inter-branch balancing entries for documents that involve multiple branches, you need to enable the Inter-branch transactions functionality in the Enable/disable functionalities (CS100000) window, configure the posting ledger by selecting the check box in the Branch accounting column for this ledger in the Ledgers (GL201500) (GL201500) window, and define the inter-branch account mapping by using the Inter-branch account mapping (GL101010) window.

In the Ledgers (GL201500) window, if the Branch accounting check box is cleared for the ledger,

you still can make transactions between the branches (for example, transfer fixed

assets from one branch to another), but the system does not create inter-branch

balancing entries.

The resulting batch remains unbalanced in each of the smaller

branches, but the batch is balanced in the ledger that is assigned to the

consolidating branch.

In this case, the branches are not independent, and separate

balance sheet reports cannot be prepared.

In model 2, illustrated below, the organisation has a number of branches with a certain level

of autonomy, with each branch being a legal entity.

The organisation and its

branches share most of the suppliers and customers but keep some of the trade partners

as associated with a specific branch.

Each branch keeps records of its own and has

an accountant or accounting staff.

The profitability of each branch can be equally

important.

In Visma.net ERP, autonomous branches may use separate ledgers to post their transactions or they

may post their transactions to a single ledger with no branch selected as a

consolidation branch. If the branches post their transactions to separate ledgers,

the system will generate inter-branch transactions automatically.

If the branches

use the same ledger, to balance the original inter-branch transactions in each

branch, you should select for this ledger a check box in the Branch

accounting column in the Ledgers (GL201500)

window.

This allows each branch to file reports as a separate legal

entity.

A certain level of independence requires that some of branches have their own general ledger

accounts that cannot be used by another branch.

You can use restriction groups to

assign selected general ledger accounts and subaccounts to a specific branch for use

by this branch only.

An organisation might include a number of related legal entities with complex

structures.

Each legal entity has its headquarters and locations or smaller branches

that are not separate legal entities.

In this case, each autonomous multi-location

entity keeps its own records and performs all accounting procedures.

In Visma.net ERP, such an organisation can be configured as a Model 3, which combines Model 1 and

Model 2, functioning within one Company ID.

(See the following illustration.)

Each

autonomous branch has its headquarters and locations (or smaller branches that are

not separate legal entities) configured as branches.

Each autonomous multi-location

branch records its operations to a separate ledger with a headquarters branch

specified as the consolidation branch for the ledger.

Generally, when transactions occur between any two non-independent branches in one ledger, no inter-branch transactions are generated; however, if they are needed for any reason, you can select a check box in the Branch accounting column in the Ledgers (GL201500) window for the ledger.

When the inter-branch transactions occur between any branches with different posting ledgers,

balancing inter-branch transactions will be generated automatically.

You should

create inter-branch receivable and payable accounts in each ledger and specify the

rules to be used by the system for generating balancing transactions by using the Inter-branch account mapping (GL101010) window.

Small and midsize businesses sooner or later may face the problem of growth.

They can grow by

mergers or by creating local subsidiaries or branches in new regions or countries.

Due to their locations, the organisation subsidiaries use different base

(functional) currency and should meet different reporting requirements (including

non-matching financial years); their customers and suppliers are not shared. For

historical reasons, the organisation subsidiaries may have different structures of

accounts and subaccounts.

In Visma.net ERP, such subsidiaries can have separate tenant accounts with different company IDs.

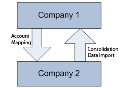

The simplest structure is shown by Model 4, illustrated below.

Although technically

the parent organisation and its subsidiaries may keep their data in the same

database, they may have different base currencies, different financial year

settings, and separate lists of trade partners. Such subsidiaries can even be hosted

on different websites.

Visma.net ERP provides the consolidation-related functionality to be used by both sides: the

parent organisation and its subsidiaries.

If different base currencies are used by

the parent company and its subsidiary, such subsidiaries can translate their

balances before they prepare the consolidation data for exporting.

If inter-branch transactions take place, they should be eliminated manually during period-end or year-end routine procedures.

Concept Information

Organisation structure - overview

Related concepts