Visma Skatt & Bokslut Pro

Employer's contribution and tax deduction reconciliation

The module for employer's contribution and tax deduction reconciliation is found under Reconciliation BS - VAT & fees - Employer's contribution and tax deduction. You can use it for continuous reconciliation, as well as reconciliation at year-end.

The bookkept values for employer's contribution and tax deduction will be automatically updated. Together with the calculated values and the amounts reported to , the module will give you a a good overview of what is bookkkept, reported and any differences between the bookkept, calculated and reported amounts.

You can expand the level of detail by clicking any underlined amount. This will display the journal entries recorded for the account.

Upload Employer's contribution and tax deduction file from

By uploading the summary from to Visma Skatt & Bokslut Pro, you automatically populate the

First, you need to download the file in pdf-format from 's Mina sidor to your computer. You do this by finding the summary under

The procedure to create a pdf can differ somewhat, depending on your environment.

Example of how the file can look like:

- Select Upload files from Skatteverket.

- Select the downloaded pdf from and select Open.

The values will be updated and saved automatically.

- Select Save.

The uploaded file is saved as an external appendix to the client account, linked to reference account

Reconciliation of employer's contribution

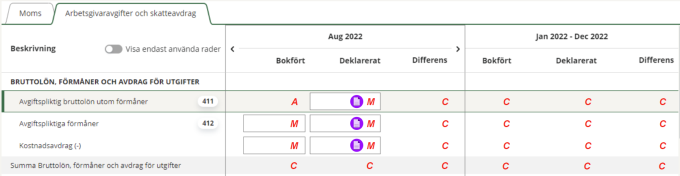

Gross salary, benefits and deduction for fee

In the Gross salary, benefits and deduction for fee section, the total for all bookkept salaries and benefits are listed, according to Skatteverket's disposition. If you haven't uploaded the file from , any values need to be entered manually here. See below for a legend of what fields are imported from the file, calculated or should be entered manually.

If needed, specify what amount should be gross salary, benefits or fee deductions. As default, the total bookept amount is displayed in the salary field.

| A | Automatically fetched from accounting values |

| M | Manually entered |

| C | Calculated |

|

Automatically entered from imported file from Skatteverket |

Basis for employer's contribution

The Basis for employer's contribution section displays all accounts that refers to salaries and benefits, with their bookept amounts.

For an account to be displayed here, it must be linked to one of the following reference accounts: 7000, 7010, 7011, 7012, 7013, 7017, 7018, 7030, 7031, 7032, 7037, 7038, 7080, 7081, 7082, 7083, 7089, 7200, 7210, 7211, 7212, 7213, 7217, 7218, 7220, 7221, 7222, 7227, 7228, 7230, 7231, 7232, 7237, 7238, 7240, 7280, 7281, 7282, 7283, 7284, 7285, 7286, 7288, 7289, 7300, 7310, 7311, 7312, 7313, 7314, 7315, 7316, 7317, 7318, 7320, 7322, 7324, 7330, 7332, 7350, 7370, 7380, 7381, 7382, 7383, 7384, 7385, 7386, 7387, 7388, 7390.

To add or delete accounts in this section, click the Add and delete accounts button that appears when you hover the row.

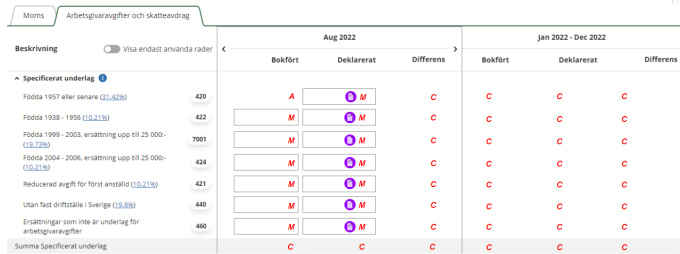

Specified basis

In the Specified basis section you can distribute the total basis in Sum Bookkept salaries on the different employer's contribution levels if needed. This applies if salaries have been paid to employees on different employer contribution levels. See below for a legend of what fields are imported from the file, calculated or should be entered manually.

| A | Automatically fetched from accounting values |

| M | Manually entered |

| C | Calculated |

|

Automatically entered from imported file from Skatteverket |

Employer's contribution

In the Employer's contribution section, you can reconcile the summary of all bookkept values from the accounts for employer contributions.

For an account to be displayed here, it must be linked to one of the following reference accounts: 7500, 7510, 7511, 7512, 7515, 7516, 7518.

To add or delete accounts in this section, click the Add and delete accounts button  that appears when you hover the row.

that appears when you hover the row.

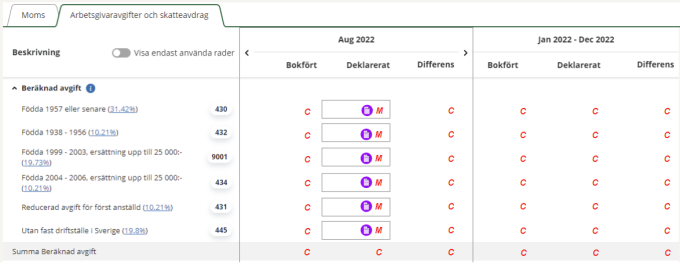

Calculated fee

In the Calculated fee section, the calculated fees for the different levels are calculated. In the column Bookkept, the fees are calculated automatically, based on the values in Specified basis. If you haven't uploaded the file from , you enter the values manually in the column Reported.

Reconcile any differences between the bookkept and the calculated fees. Any differences will be displayed in the field Difference between bookkept and calculated fee. See below for a legend of what fields are imported from the file, calculated or should be entered manually.

| A | Automatically fetched from accounting values |

| M | Manually entered |

| C | Calculated |

|

Automatically entered from imported file from Skatteverket |

Reconciliation of tax deduction

Basis for deduction

The Basis for deduction section lets you specify the basis for tax deduction. The first row Pension, annuity, insurance compensation incl. SINK is filled in automatically with the same amount as in Sum Gross salary, benefits and deduction for fee. You can adjust this if needed.

Bookkept tax deduction

In the Bookkept tax deduction section, the bookkept values of accounts linked to the reference account 2710 are listed.

Note that only the total of credit transactions are displayed. If you want debit transactions to be included in the posted amount, you must edit the amount manually.

Edit the amount by hover over the field under Wages and Benefits incl. Sink in the Posted column, click the appearing button and then select Override amount.

To add or delete accounts in this section, click the Add and delete accounts button that appears when you hover the row.

Specified Tax Deductions

In the Specified Tax Deductions section, you can specify the total tax deduction for the different levels.

Employer contribution and tax deductions to pay

In this section, all employer's contribution and tax deductions to be paid are summed up.

If you enter values in the Reported column manually, you also need to set the payment date. As default, the 12th of the nextcoming month is suggested. If the 12th is on a weekend, the nextcoming Monday is suggested.

If the date is after the current reconciliation period, the payment is not included in the summary.

Sometimes differences occur in the appendices for VAT or employer contributions between what was bookkept and declared. This is because corrections are made in the period when the error occurred and the bookkeeping is corrected when the error was discovered.

This difference cannot be easily fixed at the moment, but the easiest workaround is to keep the difference and add a comment where you explain the reason why it occured.

Create appendices

Once the reconciliation is made, you can create the appendices Employer's contribution and Tax deduction automatically by activating the Create Employer's Contribution and Tax deduction appendices automatically toggle. With this activated, the appendices will be created and kept updated automatically for as long as the period is open. When deactivated, the appendices will be deleted for the active period.

In the appendices for period reconciliation, you only see the month that you reconcile, while in year-end reconciliations, you see all the months of the year. If you also have registered payments from the tax account, these are also included in the year-end.

Activation or deactivation of the appendices only affects ongoing and not started periods. It does not affect any previous or paused periods,

Create Summary of salaries report

To get an overview of the salaries, employer contributions and tax deductions, you can use the report Summary of salaries in Report center. It will provide a pdf with the values up to the current period, three months per page.

The Bookkept column is automatically updated with values retrieved from account balances, except for the fields in the Specified basis section. If any of the account values are changed, the module is updated as long as the period is ongoing.

In the Reported column, the reported values are entered automatically if you upload the file from . If you haven't uploaded the file, the values can be entered manually.

The values in the Difference column are calculated and filled out automatically, using the formula Bookkept minus Reported.