Visma Skatt & Bokslut Pro

How are impairments of financial assets managed?

An impairment means that an asset's value is adjusted to it's actual value in the balance sheet. For example, when the value of a company's portfolio has decreased, you report this as an impairment of financial assets. According to the BAS chart of accounts, this should be recorded in account 8270.

As such costs in normal cases are not tax deductible, it should be reported in the tax return both as an impairment on INK2R, field 3.17 and as a non-deductible expense on INK2S, field 4.3.B.

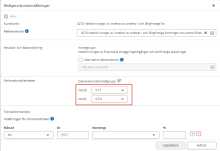

Visma Skatt & Bokslut Pro will do this automatically, providing that account 8270 has been used. To see or update this setting, go to Maintenance - Chart of accounts, search for account 8270 and select Edit.

You will also recieve a warning from the tax return check if you have entered a value in INK2R, field 3.17 but not in INK2S, field 4.3.B.