Visma Skatt & Bokslut Pro

Chart of accounts

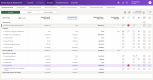

In Maintenance - Chart of accounts, you can see which accounts that have been imported into Visma Skatt & Bokslut Pro, and to which reference account it has been linked.

When adding a new account, the program will suggest the appropriate settings for the account after mapping it to a reference account.

If you wish to change the settings, click on the pen icon in the column Edit.

You can use Report center to create a report of all accounts. The report displays the Account name, Reference account, Account group and a reference to the tax forms where it's being used.

What's a reference account?

Reference accounts are used to match your account number to the base chart of accounts.

In the program, reference accounts are used to determine the following:

-

account group rows in Reconciliation BS /Analysis IS/Financial statement

-

alternative account groups in Reconciliation BS /Analysis IS/Financial statement

-

vat code rows in the VAT report

-

fields in Tax calculation

-

fields in Tax forms

-

fields in

-

automatically created system vouchers

-

autochecks in Transaction analysis

You can rename all acounts in the chart of accounts when using SIE file or Manual entry as data source.

- Click the pen-icon by the account you want to rename.

- Set the new name for the account in the Account name field.

- Select Update.

The new name will be active for the current and future financial years.

You cannot change the name of the account group in the chart of accounts. However, it is possible to add your own headings to the income statement and balance sheet by hovering over the row and clicking on the pencil icon that appears.

When you have accounts set as inactive, you can activate them from the Edit account settings dialog.

- Click the pen-icon by the account you want to activate.

- Select the Active checkbox.

- Select Update.

Accounts are active by default when they are created in Visma Skatt & Bokslut Pro. Furthermore, an account will automatically be set as active once it's used in a closing entry.

If you have accounts in the wrong place under Balance- or IS accounts, you can move them to another account group by changing the reference account.

- Select the pen-icon by the account you want to move.

- Select or type a reference account belonging to the account group to which you want to move the account.

- Select Update.

The account and its amounts will be moved to the new account group.

The change will only affect the current financial year.

Depending on whether they have a credit or a debit balance, certain accounts will be placed as either assets or liabilities in Year-end closing - Financial statements - Balance sheet.

Those of the accounts that are connected to any of the reference accounts listed below, will automatically get this alternate placement in the balance sheet by default.

You can update these settings under Maintenance - Chart of accounts by selecting the pen icon for the corresponding row, select the Alternative reference account checkbox and set the desired account.

| Reference account | Account name | Alternative reference account | Account name |

|---|---|---|---|

| 1630 | Avräkning för skatter och avgifter (skattekonto) | 2850 | Avräkning för skatter och avgifter (skattekonto) |

| 1640 | Skattefordringar | 2510 | Skatteskulder |

| 1650 | Momsfordran | 2650 | Redovisningskonto för moms |

| 1660 | Kortfristiga fordringar hos koncernföretag | 2860 | Kortfristiga skulder till koncernföretag |

| 1661 | Kortfristiga fordringar hos moderföretag | 2861 | Kortfristiga skulder till moderföretag |

| 1662 | Kortfristiga fordringar hos dotterföretag | 2862 | Kortfristiga skulder till dotterföretag |

| 1663 | Kortfristiga fordringar hos andra koncernföretag | 2863 | Kortfristiga skulder till andra koncernföretag |

| 1670 | Kortfristiga fordringar hos intresseföretag, gemensamt styrda företag och övriga företag som det finns ett ägarintresse i | 2870 | Kortfristiga skulder till intresseföretag, gemensamt styrda företag och övriga företag som det finns ett ägarintresse i |

| 1930 | Företagskonto/checkkonto/affärskonto | 2330 | Checkräkningskredit |

| 2850 | Avräkning för skatter och avgifter (skattekonto) | 1630 | Avräkning för skatter och avgifter (skattekonto) |

| 2510 | Skatteskulder | 1640 | Skattefordringar |

| 2650 | Redovisningskonto för moms | 1650 | Momsfordran |

| 2860 | Kortfristiga skulder till koncernföretag | 1660 | Kortfristiga fordringar hos koncernföretag |

| 2861 | Kortfristiga skulder till moderföretag | 1661 | Kortfristiga fordringar hos moderföretag |

| 2862 | Kortfristiga skulder till dotterföretag | 1662 | Kortfristiga fordringar hos dotterföretag |

| 2863 | Kortfristiga skulder till andra koncernföretag | 1663 | Kortfristiga fordringar till andra koncernföretag |

| 2870 | Kortfristiga skulder till intresseföretag, gemensamt styrda företag och övriga företag som det finns ett ägarintresse i | 1670 | Kortfristiga fordringar hos intresseföretag, gemensamt styrda företag och övriga företag som det finns ett ägarintresse i |

| 2330 | Checkräkningskredit | 1930 | Företagskonto/checkkonto/affärskonto |

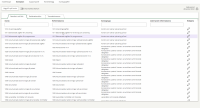

| VAT type | Description |

|---|---|

| Creates output VAT |

Accounts that generate output VAT (for example sales). When an account with this setting is in a journal entry, another account with setting Output VAT shall also be in the journal entry. The amount on the account with setting Output VAT shall be a certain percentage of the amount booked on the account with setting Creates output VAT. If 0% is entered, the account is handled as exempt from VAT. |

| Creates input VAT |

Accounts that generate input VAT (for example purchases). When an account with this setting is in a journal entry, another account with setting Input VAT shall also be in the journal entry. The amount on the account with setting Input VAT shall be a certain percentage of the amount booked on the account with setting Creates input VAT. If 0% is entered, the account is handled as exempt from VAT. |

| Creates output/input VAT |

Accounts that generate both output and input VAT. When an account with this setting is in a journal entry, accounts with the settings Output VAT and Input VAT shall also be in the journal entry. The amounts on the accounts with the settings Output VAT and Input VAT shall be a certain percentage of the amount booked on the account with setting Creates output/input VAT. In Sweden this setting is used when purchasing from EU or accounts with reversed VAT. |

| Output VAT | Accounts defined as output VAT. |

| Input VAT | Accounts defined as input VAT. |

| VAT reconciliation |

A journal entry that includes an account with this setting shall be ignored by the VAT check. When an account with this setting is included in a journal entry, it is not a sale or a purchase, but an accounting entry that always is recorded at the end of the reconciliation period. |

| No VAT | No VAT is used for accounts with one of the standard VAT types, that should not be included in the VAT check for a particular company. When No VAT is selected, the VAT type is removed. |