Visma Skatt & Bokslut Pro

VAT reconciliation

The module for VAT reconciliation is found under VAT & fees - VAT in the reconciliation balance sheet. It is automatically updated with accounting data imported to Visma Skatt & Bokslut Pro.

The module for VAT reconciliation in Visma Skatt & Bokslut Pro consists of the same sections and rows that are used in VAT report of the . It is automatically updated with the accounting data imported to the program, and gives you a good overview of the registered VAT, the VAT reported to , and possible differences between the registered and the reported amounts. You will also find information about transfers to the account for VAT settlement, and payments and/or repayments made.

The reconciliation appendix VAT specification is created automatically from the VAT reconciliation as default.

You can use it for continuous reconciliation, as well as reconciliation at year-end.

You can also set what accounts to be included in the VAT reconciliation. Read more in Add and delete accounts in VAT report.

The VAT reconciliation is based on the usage of account 2650 for VAT settlement.

Select a VAT period

Before you get started, you need to select a VAT period. This is done at the top of the left hand panel. You can choose between Monthly, Quarterly and Yearly. Month is the default option. If you choose monthly VAT reconciliation, one column for each month is created. If you choose quarterly VAT reconciliation, one column for Jan-Mar, one column for Apr-Jun, and so on, are created.

Changing VAT periods during an ongoing financial year

It is possible to change VAT periods during an ongoing financial year, even when the previous reconciliation months are locked.

Please note the following when changing the VAT period:

- Previous reconciliation periods are not affected by the change.

- Manually added values from previous VAT periods will not be copied to the new VAT period.

- It is not possible to change the VAT period in locked reconciliation periods.

Upload VAT file from

By uploading the

First, you need to download the file in pdf-format from 's Mina sidor to your computer. You do this by finding the

The procedure to create a pdf can differ somewhat, depending on your environment.

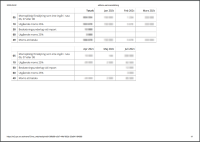

Example of how the file can look like:

All fieds used in the VAT-report will be automatically populated when you do an import. Only the Payment (-) / repayment (+) and Payment date fields must be entered manually.

- Select Upload files from Skatteverket.

- Select the downloaded pdf from and select Open.

The values will be updated and saved automatically.

- Select Save.

The uploaded file is saved as an external appendix to the client account, linked to reference account

The structure of the VAT reconciliation

The module for VAT reconciliation consists of different sections with numbered rows. This is the same structure that is used in s VAT report.

Which accounts are mapped to which rows?

In Visma Skatt & Bokslut Pro, client accounts are connected to reference accounts. Each row in the VAT reconciliation is mapped to one or more reference accounts, which in turn determine which one of the client accounts that are displayed under each row. Only accounts with registered transactions are displayed.

Click on a row to view its underlying accounts.

There is a default mapping between the rows in the VAT report and their underlying accounts. If you want to make adjustments to this, you can do it by adding and removing accounts for each row. Read more in Add and delete accounts in VAT report.

Sometimes differences occur in the appendices for VAT or employer contributions between what was bookkept and declared. This is because corrections are made in the period when the error occurred and the bookkeeping is corrected when the error was discovered.

This difference cannot be easily fixed at the moment, but the easiest workaround is to keep the difference and add a comment where you explain the reason why it occured.

| Row | Reference accounts |

|---|---|

| A. Sales/withdrawals subject to VAT excluding VAT | |

| Sales subject to VAT (05) | 3001, 3002, 3003, 3008, 3062, 3100, 3308, 3510, 3520, 3540, 3561, 3562, 3563, 3590, 3610, 3690, 3732, 2420, 2429, 6351 |

| Withdrawals subject to VAT (06) | 3000 |

| Tax assesment basis profit margin (07) | 3211 |

| Rental income at voluntary tax obligation (08) | 3913 |

| B. Output VAT for sales | |

| Output VAT 25% (10) | Transactions recorded on accounts connected to reference account 2611, 2612, 2613 or 2616, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2611, 2612, 2613 or 2616, in combination with accounts connected to reference account 1650 or 2650. |

| Output VAT 12% (11) | Transactions recorded on accounts connected to reference account 2621, 2622 or 2626, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2621, 2622 or 2626, in combination with accounts connected to reference account 1650 or 2650. |

| Output VAT 6% (12) | Transactions recorded on accounts connected to reference account 2631, 2632 or 2636, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2631, 2632 or 2636, in combination with accounts connected to reference accounts 1650 or 2650. |

| C. Purchases subject to VAT, reverse charge | |

| Purchasing of goods from other EU country (20) | 4515, 4516, 4518 |

| Purchasing of services from other EU country (21) | 4535, 4536, 4537 |

| Purchasing of services from non-EU country (22) | 4531, 4532, 4533 |

| Purchasing of goods within Sweden (23) | 4415, 4416, 4417 |

| Other purchasing of services (24) | 4041, 4042, 4043, 4425, 4426, 4427 |

| D. Output VAT for purchasing line 20-24 | |

| Output VAT 25% (30) | Transactions recorded on accounts connected to reference account 2614, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2614, in combination with accounts connected to reference account 1650 or 2650. |

| Output VAT 12% (31) | Transactions recorded on accounts connected to reference account 2624, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2624, in combination with accounts connected to reference account 1650 or 2650. |

| Output VAT 6% (32) | Transactions recorded on accounts connected to reference account 2634, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2634, in combination with accounts connected to reference account 1650 or 2650. |

| H. Import | |

| Basis for tax calculation of imports (50) | 4545, 4546, 4547 |

| I. Output VAT for import line 50 | |

| Output VAT 25% (60) | Transactions recorded on accounts connected to reference account 2615, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2615, in combination with accounts connected to reference account 1650 or 2650. |

| Output VAT 12% (61) | Transactions recorded on accounts connected to reference account 2625, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2625, in combination with accounts connected to reference account 1650 or 2650. |

| Output VAT 6% (62) | Transactions recorded on accounts connected to reference account 2635, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2635, in combination with accounts connected to reference account 1650 or 2650. |

| E. Sales etc exempt from VAT | |

| Sales of goods to other EU country (35) | 3108, 3521, 3541, 3737 |

| Sales of goods to non-EU country (36) | 3105, 2522, 3530, 3542, 3736 |

| Intermediary purchase of goods (37) | 4055 |

| Intermediary sales of goods (38) | 3057 |

| Sales of services to trader who has tax obligations in another EU country (39) | 3048, 3300 |

| Other sales of services performed outside of Sweden (40) | 3305 |

| Sales to buyer that has tax obligations in Sweden (41) | 3231, 3612 |

| Other sales aso (42) | 3004, 3911, 3921, 3940, 3950, 3985, 3987-3990, 3994, 3996-3997 |

| F. Input VAT (48) | |

| Transactions recorded on accounts connected to reference account 2640, 2641, 2642, 2645, 2647, 2647 or 2649, excluding the transactions also recorded on accounts connected to reference account 1650 or 2650. | |

| Transferred VAT | Transactions recorded on accounts connected to reference account 2640, 2641, 2642, 2645, 2647, 2647 or 2649, in combination with accounts connected to reference account 1650 or 2650. |

Display transactions

It is possible to display the journal entries that are registered on the accounts in the VAT reconciliation. Underlined amounts are clickable and when you click on one of those, the Account analysis dialogue is opened. In this dialogue, all of the transactions that have been registered on the account are listed.

When input and output VAT have been transferred to and recorded on the account for VAT settlement, the transferred VAT will be displayed on a separate row below each affected VAT account.

The Bookkept column is automatically updated with values retrieved from account balances. If any of the account values are changed, the Employer's contribution module is updated as long as the period is ongoing.

In the Reported column, the values reported to are entered manually.. If you have selected a quarterly or yearly VAT period, or yearly VAT period, the last month in the period must be ongoing in order for you to enter a value here. During ongoing, but not yet finished, periods, preliminary amounts are displayed in this column to avoid differences.

These preliminary amounts are the same as the ones that are displayed on the corresponding rows in the Bookkept column.

The values in the Difference column are calculated and filled out automatically, using the formula Bookkept minus Reported.

The program automatically calculates the total VAT debt or VAT recoverable, based on the registered input and output VAT, on the row G. VAT due (+) or returned (-).

Payments or repayments are registered on the row below. An automatic recalculation of the remaining debt or recoverable is then performed. The amount is entered in the VAT period which the payment/repayment concerns, and not in the period when the payment/repayment was made.

You have a VAT debt for January and the payment is made on March 12th. When you perform the VAT reconciliation in March, you register the payment in the column for January and select March 12th as payment date.

The reconciliation appendix VAT specification is created automatically from the VAT reconciliation as default. You can deactivate (and reactivate) this functionality down to the left. The appendix is connected to the client account that is mapped to reference account 2650.

If any of the amounts in the VAT reports are changed, the appendix is updated automatically with the changes as long as the period is ongoing.

If you want to change any of the values on the appendix, you must do so via the VAT reconciliation.

To remove the appendix from an ongoing period, you must deactivate its auto-generation from the VAT reconciliation.

Depending on your selected VAT period, the appendix will be created:

- For each month, if you have selected the monthly VAT period.

- In the last month of each quarter, if you have selected the quarterly VAT period.

- In the year-end period, if you have selected the yearly VAT period.

Related topics

Search word: VAT reconciliation VAT appendix