Visma Skatt & Bokslut Pro

Closing entries

Closing entries is located under both Period closing and Year-end closing.

If a reconciliation difference should occur in Reconciliation BS - Overview or in an appendix, you can create a closing entry by clicking on the blue scale icon.

When you create a closing entry from an account in the overview or from a main appendix, the program will automatically suggest a name and an offset account, based on your previous entries.

For these reconciliation accounts, the following offset accounts are proposed:

| Reconciliation account | Offset account |

|---|---|

| 2513 | 5191 |

| 2920 | 7090 |

| 2910 | 7010 |

| 1400 | 4900 |

| 2514 | 7530 |

| 2515 | 7550 |

| 1720 | 5615 |

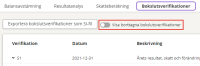

You can also go to Closing entries and create the closing entry there. Here, a list of all closing entries that have been created is displayed. You can expand each closing entry to view the details. Any deleted closing entries will be hidden by default. You can display them by using the Show deleted closing entries toggle.

When dimensions such as cost centres and projects exist in your accounting, you can use them when creating the closing entry. Dimensions can be connected to any account.

You must also transfer the closing entries that you create in Visma Skatt & Bokslut Pro to your accounting software. If you don´t want to transfer them, you have to set them as Not applicable for transfer. This setting is available for all manually created closing entries and for some automatically generated closing entires (see below) and only in the year-end period. In that case, they will only affect the balances in Visma Skatt & Bokslut Pro.

System journal entries

In addition to the closing entries you create yourself, there are some entries that are generated automatically by the system:

- A closing entry for change of additional depreciation of machinery and equipment is automatically created, based on the choice you have made for provision or resolution in Year-end closing - Tax calculation - - Additional depreciation of machinery/equipment.

- A closing entry for this year's result, income tax and change of tax allocation reserve is automatically created, based on your choice for allocation or reversal in Year-end closing - Tax calculation - Profit/loss planning.

- If the appendix Summary of the year's tax liability/claim (which is automatically generated after making a choice for allocation or reversal in Year-end closing - Tax calculation - - Profit/loss planning) is connected to one or several sub-appendices or accounts for tax liabilities, a closing entry which transfers the amounts from the sub-accounts to the selected main account for tax liability is automatically generated. The option to create the closing entry is enabled by default but can be turned off by de-selecting the Create closing entry automatically toggle on the appendix Summary of the year's tax liability/claim.

- The closing entry Rebooking of balances on deposit and withdrawal accounts to the account for Equity (sole proprietorships) is automatically created when you add the Equity specification for sole proprietorships appendix. This one empties the accounts mapped to the reference accounts 2011-2018 and transfers their balances to the selected equity account. These rebookings are displayed as own rows on the main appendix for the accounts in question. This closing entry is possible to mark for Not applicable for transfer.

- The closing entry Booking of profit for the year (sole proprietorships) is automatically created when you add the Equity specification for sole proprietorships appendix. This one registers the profit for the year, by retrieving the amount for Calculated profit/loss in the income statement and deducting the recorded amounts (if any) on accounts mapped to reference account 8999. This closing entry is possible to mark for Not applicable for transfer.

- When using manual entry, the program will automatically generate a closing entry named Automatic system voucher based on manually entered balances which will include the changes for each account.

You can edit, print or delete a closing entry by clicking the symbols in the Action column. If you want to print all closing entries, you do this via Report Center.

If you import accounting data into Visma Skatt & Bokslut Pro again, you will be asked if you want to exclude the closing entries that you have created in Visma Skatt & Bokslut Pro from the account balances. They will then get the Transferred-Excluded status.

Entries with the status Transferred-Excluded are not included in the balances in Visma Skatt & Bokslut Pro, since we are assuming that these entries have been recorded in your accounting software and are included in the new import.

Only closing with the statuses Not transferred and Transferred (and Not applicable for transfer, if you are working in the year-end period) affect the balances in Visma Skatt & Bokslut Pro.

Export as SI file - when you have SIE file as data source

When you have SIE file as data source, the button Export closing entries as a SI file appears under Closing entries. Once clicked, you will create a SI export file containing all closing entries with the status Not transferred. This file can be used to transfer the closing entries to other ERPs that support the import of this file type.

- If there are entries with the status Not transferred when you are locking a period, the system will ask you if you would like to export them as an SI file.

- When the export is done, the closing entries will receive the status Transferred.

Export closing entries to Visma eEkonomi - when you have Visma eEkonomi as data source

When you have Visma eEkonomi as data source, the button Export closing entries to Visma eEkonomi is displayed under Closing entries. When you click on it, all closing entries with the status Not transferred will be transferred to Visma eEkonomi.

- If there are entries with the status Not transferred when you are locking a period, the system will ask you if you would like to export to Visma eEkonomi.

- When you have connected dimensions to a closing entry in Visma Skatt & Bokslut Pro, the closing entry will be updated in Visma eEkonomi. This applies under condition that the dimension exists in Visma eEkonomi.

- Exported closing entries to Visma eEkonomi, can be saved in a separate journal serie. You do this setting in Visma eEkonomi, under Settings - Company settings - Accounting settings - Journal series - Closing entries.

- When the export is done, the closing entries will receive the status Transferred.

In the year-end period, it is possible to select entries that are not relevant to transfer back to your accounting software, by setting them as Not applicable for transfer. These entries will not be included in an export, which means that they will only affect balances in Visma Skatt & Bokslut Pro. This option is only available for entries with the status Not transferred.

Related topics

Equity specification for sole proprietorships

Tax depreciation for machinery and equipment (only limited companies)

Searchword : System voucher, closing voucher, year-end voucher