Visma Skatt & Bokslut Pro

Fixed asset specification

You create a sub-appendix by pressing the paperclip icon  from Reconciliation BS - Overview or Reconciliation BS - Appendices.

from Reconciliation BS - Overview or Reconciliation BS - Appendices.

The Fixed assets - Specification appendix is used to calculate depreciation and residual value of your assets and can be used to reconcile accounts Cost of acquisition, Accumulated depreciation and Depreciation this year. When a fixed asset is marked as disposed or sold, additional account rows for reconciliation of profit and loss will be created.

You can add multiple appendices for the same account group. These will then be compiled in the Fixed Assets - Overview appendix that is automatically created. Read more about this in the Fixed asset summary topic.

This appendix can also be generated automatically when you import data from Visma eEkonomi. The service then creates one specification appendix per acquisition account and an overview appendix, common for all. Only assets that are set as active in Visma eEkonomi are transferred.

Note that if you have created manual Fixed assets - specification appendices before, they will still be present after importing. You will need to remove them to avoid duplicates.

If the Specify previous depreciations dialogue in Visma eEkonomi contains starting values, these are set per financial year. They are shown in the appendix as follows:

- Accumulated depreciation for previous financial years is displayed in the Open bal for acc depr column.

- Accumulated depreciation for the current year is displayed in the Acc depr this year column. They are thus never displayed in the Depr. for the period column.

Calculation of depreciation and carrying amount

- Specify which accounts to use for cost of acquisition, accumulated depreciation and depreciation this year in the Account section.

- Enter the Date of acqusition, Description, Cost of acquisition and Useful life in months for each fixed asset.

- Adjust the depreciable amount if needed.

- Select Add row (+) to create a new row.

When you leave the fields, the depreciation is calculated automatically from the date of acquisition and the calculated values are displayed on each row.

The bottom part of the screen shows a summary for all fixed assets. The column Sum is also displayed in the auto-generated appendix Fixed Assets - Overview .

Financial year: 20XX-01-01-20XX-12-31

Reconciliation period: Dec 20XX

Date of acqusition: 20XX-01-01

Cost of acquisition: 8 000 000

Depreciable amount: 7 500 000

Useful life in months: 120

| Field | Description |

|---|---|

| Open bal for acc depr |

Depreciable amount / Useful life in months * number of months / days from date of acquisition to the beginning of the current financial year. 7 500 000/120 * 12 (20X1-01-01 - 20X2-01-01) = 750 000 Example: Date of acquisition 20X1-01-15 Jan: 7 500 000/120/31 (no of days in Jan) * 16 ( 20X1-01-15 - 20X2-01-01) = 32 258,06 Feb-dec: 7 500 000/120 *11 (20X1-02-01 - 20X2-01-01) = 687 500 32 258,1 + 687 500 = 719 758,06 |

| Acc depr this year (period) |

Depreciable amount / Useful life in months * number of months / days from the beginning of the current financial year until the reconciliation period. 7 500 000/120*11 (20XX-01-01 - 20XX-11-30) = 687 500 |

| Acc depr this year (year-end) |

Depreciable amount / Useful life in months * number of months in the current financial year. 7 500 000/120 * 12 (20XX-01-01 - 20XX-12-31) = 750 000 |

| Depr for the period (period) |

Depreciable amount / Useful life in months * number of months in the period. 7 500 000/120*1 (20XX-12-01-20XX-12-31) = 62 500 |

| Total acc.depr. |

Open bal for acc depr + Acc depr this year + Depr for the period 750 000 + 687 500 + 62 500 = 1 500 000 |

| Carr amount |

Cost of acq - Total acc depr 8 000 000 - 1 500 000 = 6 500 000 |

Sales and disposals

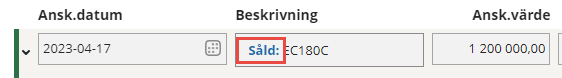

When a fixed asset is sold or disposed, you register this by clicking the blue icon to the right of the current line. If you specify the sale price, the program will calculate the profit or loss. Two new rows are added to the appendix and you can link the appendix to the corresponding accounts - Gain on sales or Loss on sales. When an asset has been sold or disposed, the row will be greyed out and Sold or Disposed will be displayed in the Description field:

Copy and calculation for the next period

If you have selected the appendix to be copied to the next period, the calculations for the columns Open bal for acc depr., Acc depr this year, Total acc depr and Total carrying amount will be recalculated to include the new period as well.