Visma Skatt & Bokslut Pro

Tax planning for private individuals

You find the tax planning module from Year-end closing - Tax planning. As a first step, the tax planning can be used to calculate salary based scope, salary requirement and dividend in close companies.

The tax planning section is available to private individuals from income year 2023. It is separated from the ordinary tax return module and can thus be used stand alone. Some tips on how to use it can be found in the forum post Beräkna lönekravet (2023) i fåmansbolag med Visma Spcs.

If you use Visma Skatt & Bokslut Pro as a company, you can instead use the appendix K10 - Qualified shares in close companies to calculate the salary-based space and the salary requirement that needs to be met by your own salary withdrawal.

Here is how you do it

-

Open the tax planning module from Year-end closing - Tax planning.

-

Add the current tax rates for the private individual on the Basic information tab.

-

Add any earned and capital income together with surplus from business activity on the Other income tab.

-

Go to the Tax calculator page.

-

Click Add tax calculation in the lower left corner and select Qualified shares in close companies.

-

Addinformation about the company and other required settings on the Basic information tab.

-

Enter information about the company's total number of shares and partner events, such as purchases, sales et.c. in the Events tab.

-

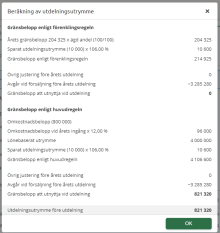

Enter information about the salary total rule, if applicable, on the Salary basis tab. With the Show calculations - scope of dividend link, you can see whether the salary requirement has been fulfilled or not.

-

Enter saved scope of dividend and how it's used during the income year on the Saved amount limit tab.

-

Enter date and amount for the year's dividend under the This year's dividend tab. You will get a summary of the distribution between the dividend taxed on capital and employment, respectively.

The link Show calculations - scope of dividend provides a detailed description of how the scope of dividends has been calculated. It shows the comparison between the main rule and the simplification rule and automatically selects the best rule.

-

If the partner has made any sales during the year, a calculation of the profit or loss is shown on the Sales of the year tab.

Related topics

Tax planning for private individuals, Basic information tab

Tax planning for private individuals, Tax calculator tab

K10 - Qualified shares in close companies

Digital submission - question and answers

Declarations in Visma Skatt & Bokslut Pro

Searchwords : fåmansbolagskalkyl, fåmansbolag, skatteberäkning, skatteplanering