Visma eEkonomi Pro

Add accounting template for purchase invoice

When you add a new accounting template and select Purchase invoice as Scope of use, the template can be used directly on the purchase invoice or you can choose to save it on the supplier in the supplier register. If there is an existing accounting template saved on the supplier it will be preselected when you create a new purchase invoice. If the supplier does not use a template and you select a template when creating the invoice, it will be saved automatically on the supplier.

It is also possible to choose another accounting template on the purchase invoice than the preselected. If you do that, the program will ask if you want to use this template only on this invoice without updating the supplier, or if you want to update the supplier with the new template.

- Go to Settings - Accounting templates.

- Select New accounting template.

- Add Name, Journal series, and Description.

- In the Scope of use field, select Purchase invoice.

-

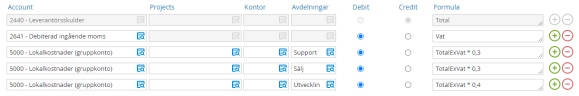

Add the accounts you would like to include in your template.

-

In the Formula fields, it is possible to build your own formulas by using the formula buttons above.

In the Field explanations below, you can read more about how to use the formulas including two examples.

- Select Save.

New accounting template window

To be able to use an Accounting template, the template must have the status Active and contain accounts that are active.

Specify a journal series that you want to be associated with the accounting template.

Here, you can describe how and when the accounting template is intended to be used.

When you specify a scope of use, only general ledger accounts relevant to the usage area in question can be selected in the account list. The scope of use controls in which parts of the program the accounting template is available.

You can control whether an amount for a specific account should always be indicated as a Debit or Credit. This reduces the risk of posting errors.

Here, you can add projects and cost centres to the selected ledger accounts.

Here you add a formula for each account and decide how the calculation should be done.

Create formulas

| Variable | Description |

|---|---|

| Total | The amount is taken from the Total amount field on the invoice. |

| TotalExVat | This is the remaining amount when subtracting the total amount with the VAT. The amount is taken from the Amount excl. VAT field on the invoice. |

| Vat | The amount from the VAT field on the invoice. |

| Account | When using this variable you can base a formula on an amount from another account used in the template. Select the Account button and then enter the account number manually on the account you want to include in your formula. |

Here is an example of Pensionsförsäkring med särskild löneskatt. We have a fixed amount of 5 000 SEK on account 7490, which is a recurring amount for that account. The remaining amount from Total - 5 000 SEK is placed on the account 7411. The formulas for account 7533 and 2732 are based on the calculated amount from account 7411 multiplied with 24,26%.

Related topics

|

Add new ledger account |

|

Add new accounting template |

|

Add accounting template for manual journal entry |

|

Accounting templates |

Work smarter

This is how you can work most effectively

Video tutorials

Search word: accounting template, automatic entry