Visma Skatt & Bokslut Pro

News in Visma Skatt & Bokslut Pro

New functionality

Now you can report with K2 for trading partnerships and limited partnerships!

For financial years ending on or after 31 December 2024, the program now also supports the K2 regulations with annual report (BFNAR 2016:10) for trading partnerships and limited partnerships. An important step for us to offer you complete support for all types of businesses!

What company types and regulations are supported in Visma Skatt & Bokslut Pro?

Customer request

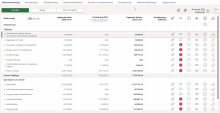

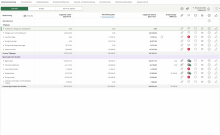

Open the balance sheet or income statement in a separate window

Following requests, we have now added a function to open the balance sheet and income statement in a new window! The window opens with a button from the Reconciliation BS or Analysis IS page and can be moved and resized as required. The window remains when you change periods, navigate around the service and also when you change companies. To close the window, click on the Close button. Of course, it also closes when you log out or close the browser window where the program is open.

Customer request

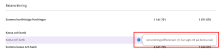

Now we show where the rounding is placed!

Now you can see where any roundings have been placed. The rows containing roundings are marked with an information icon both in the income statement and balance sheet in the annual report and on the INK2R tax form.

New functionality

New calculation appendix - forest deductions

There is now a new calculation appendix to calculate the year's forest deduction, the remaining deduction margin, the reversed forestry deduction and any increase or decrease in the deduction margin due to purchase or sale. You can use the calculation appendix to automatically fill in the necessary fields on tax appendix N8 or stand-alone, as a calculation aid.

Legal update

Support for the 2024-P4 taxation period for sole proprietorships and private individuals

In the year-end period we now support all financial/calender years year until 2024-12-31. The tax forms are now also updated for the 2024-P4 taxation period

New tax rules in year 2024 for private individuals

- The earned income tax credit ("jobbskatteavdraget") is strengthened for all.

- The age limit for the earned income tax credit is raised from 65 to 66.

- The special basic deduction is strengthened.

- The roof for ROT and RUT is temporarily separated and raised to 75000 for ROT.

- Suspended upward adjustment of the central government tax threshold.

Other changes

- Skatteverket has changed the appearance of Other information on INK1 regarding information on foreign income and tax.

- We have added fields for redistribution of tax reduction for green technology in the same way as already exists for ROT/RUT.

- On the page Sales of the year in the declaration annex K10, we have added a setting to affect the transfer of profit to INK1. In some deferral contexts, it may not be appropriate to transfer profits to INK1.

- The section directly below the profit/loss planning to clarify the overall tax calculation for the company is now also available for sole proprietorships.

New functionality

Tax planning 2025 for partners in close companies

It is now time to calculate the salary requirement in the last part of 2024 in order to be able to utilise the salary based scope next year 2025. The tax planning for 2025 opens on 1 October 2024 and is available to private individuals. It is separated from the other declaration and can therefore be used completely independently.

If you used tax planning for 2024, the relevant data will be transferred to tax planning 2025 when you click the button Copy tax planning from previous year.

Tax planning for private individuals

Beräkna lönekravet (2024) i fåmansbolag med Visma Spcs (In Swedish)

New functionality

Archiving of old periods and years

We have added a feature that automatically archives all information older than 5 years. For archived periods, it is only possible to use the Report Center to print reports.

- All periods older than 5 years will be displayed with the text Archived.

- The periods are permanently locked and cannot be unlocked.

- When an archived period is opened, you are taken directly to Report Center.

- In an archived period, all menu items are inactive, except Maintenance - Settings - Reset company, which can be done even in archived periods.

Customer request

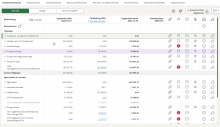

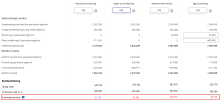

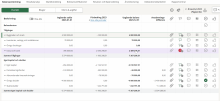

Now you can see the tax arrears/refund directly in the profit/loss planning!

We have added a section directly below the profit/loss planning to clarify the overall tax calculation for the company. You can see all the options' final tax, preliminary tax and tax arrears/refund immediately without having to switch pages for each option. Previously, you had to go into the tax calculation to see any tax arrears/refunds, but now you see it directly on the profit planning page. Get rid of some unnecessary clicks while making the program clearer!

Refunds are shown in blue and tax arrears in red and minus signs. The change applies to limited companies and economic associations and for financial years ending after 31 December 2023.

New functionality

New calculation appendix - Depreciation deduction - buildings/land improvements

As of P4 2024, the program can help you calculate depreciation deductions on buildings and land improvements. The new calculation appendix will help you calculate this year's depreciation deduction and keep track of previous years' deductions. You can make calculations for several buildings/facilities. The result will be displayed on the Summary tab and transferred to the appropriate field on the INK2S, INK4S or NE tax forms, depending on the type of company. If you do not want to transfer the data automatically, you can of course switch this off.

Depreciation deduction - (sole proprietorship)

Depreciation deduction - buildings/land improvements (limited companies and economic associations)

Depreciation deduction - buildings/land improvements (trading associations)

Legal update

Support for taxation period 2024-P4

In the year-end period we now support all financial/calender years year until 2024-12-31. The tax forms have been updated with the current forms for taxation period 2024-P4.

Other improvements:

Extended link between tax form N9 (deduction limitation) and INK2R fields 3.18/3.16

Customer request

Changes in the General annual meeting protocol

On the page Annual general meeting protocol - Basis, we have divided the name fields into First name and Last name. This is to ensure that the names match the names on the Signatures page.

Under Decision on the auditor, we have also added a new role - Deputy auditor as well as a selection for Name of the accounting office and the Main responsible.

New functionality

Late summer and cow release - new reconciliation appendices for stock in agriculture!

Late summer and cow release - new reconciliation appendices for stock in agriculture!

We have added three new appendices to make it easier to keep track of stocks in businesses working with animals, crops or forestry.

- Stock in agriculture (animals)

- Stock in agriculture (produced stock)

- Stock in agriculture (bought stock)

The appendix Stock in agriculture (animals) is used to value livestock based on the average production cost of livestock determined each year by Skatteverket. The appendices Stock in agriculture (produced stock) and Stock in agriculture (bought stock) can be used to calculate the stock of own-produced or purchased goods such as grain, plant products, fertilisers, seeds etc.

List of appendices in Visma Skatt & Bokslut Pro

Stock in agriculture (animals)

Improvement

Improvement in the Stock specification appendix

Now you can choose whether the Current value should be labelled as Net selling price or Current cost in the Stock specification appendix. Before, the current value was always referred to the current cost, but since both valuation principles can be used, it is now possible to choose which one applies.

Customer request

We help you be more efficient - now more checkpoints are automatically updated in Visma Advisor!

For you who use Visma Skatt & Bokslut Pro via Visma Advisor, we have now further enhanced the update of checklists. If you have set up yearly tasks for tax forms in Visma Advisor, they will be automatically set as Completed when the following happens in Visma Skatt & Bokslut Pro:

- Tax return - Submitted to Skatteverket for signing

- Tax return - Signed at Skatteverket

This is a really good improvement that will help you to be really efficient in your daily work and always have the right status in your different tasks. You will save a lot of time and it will be easy to follow Rex or Reko. Just make sure you have the right settings in Visma Advisor and then follow the process in Visma Skatt & Bokslut Pro and the service will do the rest.

Customer request

Improvements to the reconciliation appendices for FORA and special employer's contribution

The Calculation year reconciliation FORA appendix:

- The percentage fields that were previously locked can now be changed manually.

- Information on the income base amount or price base amount is added in the appendix.

- A new section has been added: Calculation of debt/claim Fora for accrued wages and holiday pay debt.

The Special employer's contribution appendix:

- Amounts automatically retrieved from the FORA appendix can now be changed manually.

- The periods on which the calculations are based are now shown in the appendix.

New functionality

Import of SIE1 files

Previously it only worked to import SIE4 files, but now we have also added support for importing SIE1 files in Visma Skatt & Bokslut Pro! There are some differences between SIE1 and SIE4 files. The main difference is that there are no transactions or dimensions in a SIE1 file, only annual balances. Therefore, when selecting a SIE1 file as data source, period reconciliation or transaction analysis will not work.

Improvement

Receive a notification when a report is ready in the report centre

When creating larger reports in the report center, it can sometimes be difficult to know when they are ready. Therefore, we have simplified it a bit.

- When you create a report, a message appears telling you that you can continue working on other things while the program is working.

- If you have started to create a report, continue working on something else and then return to the Report Center, the generated report will be displayed directly in the Report Center.

- Once a report has been created, a notification will appear in the top menu. When you click on it, you will see a message that the report is ready and a link that you can click on to download it.

Customer request

On request - create your own notes!

Yep, you read that right! We are now adding even more flexibility to the annual report by allowing you to create your own notes. You create them in the annual report by clicking on Add. In the note you can then add an optional heading and texts. You can also include a table showing values for the current and previous year. Of course, you can also link the note to the relevant rows in the income statement or balance sheet. When you submit the annual report digitally to Bolagsverket, the note will be included as untagged data. You can currently add up to three own notes.

The possibility to create own notes is available for limited companies using K2 or K3 and for financial years ending in 2023 or later.

Legal update

Support for taxation period P3 2024

The program now supports period 2024 P3

The tax forms INK2,

Skatteverket will not open the submission service for the period until 31 August 2024.

Customer request

Change the order of notes

You can now change the order of the notes in the annual report by dragging and dropping them where you want them. It works for all types of companies that have annual reports (not annual accounts) and for financial years ending on or after 30 September 2023.

Customer request

A more flexible way of presenting key figures in the annual report

We have received requests for better and more flexible handling of key figures in the management report. That's why we have made these changes:

- For K2 it was previously only possible to include the three mandatory key figures Net turnover, Profit after financial items and Solvency. These three are still mandatory, but now there is also the possibility to choose more key figures, such as Operating margin, Balance sheet total and Average number of employees.

- For K3 companies, you can now freely choose which key figures to include.

New functionality

We now also support trading partnerships and limited partnerships!

The family just keeps growing and growing! We now welcome partnerships and limited partnerships for financial years ending on or after 31 December 2023. Of course, full support for reconciliation, tax calculation and tax forms. For the year-end closing, Årsbokslut (BFNAR 2017:3) is initially supported.

Tax calculation for trading partnerships and limited partnerships

Legal update

Support for taxation period 2024 P2

The program now supports period 2024 P2

The tax forms INK2, N3B, N4, N7, N8 and N9 look exactly the same as the forms for the previous periods, except for the bar codes.

Skatteverket will not open the submission service until June 27 2024.

New functionality

Exciting News: the Visma Spcs AI Assistant!

We're thrilled to announce the launch of our latest innovation – the Visma Spcs smart AI chat bot, or simply put the AI Assistant! Here's why you'll want to give it a go and make the most of it:

Instant response 24/7

Whether you’re a night owl or an early bird, the AI Assistant is available around the clock, every day, ready to answer your questions whenever you need it. No queueing and instant help of course.

Smooth smart conversation

Say no to awkward robotic chats and weirdly formulated questions! Chat with the AI Assistant using everyday language and ask follow up questions. It’ll be able to follow your conversation - just like you’re talking to a real person.

Continuous learning

The AI Assistant gets smarter by every chat, so it’s constantly getting better at helping you with your questions. But don’t worry, the AI Assistant is no rookie! It has already been through rigorous training with our superb customer support team.

Multilingual

Not that comfortable with English? ¿Qué tal el español? Ou français? The AI Assistant is multilingual, ready to engage with you in the language you prefer! Incredibile, vero?

Amazing things to come

We are constantly improving the AI Assistant and our dreams for the future are nothing short of bold. So join us on the journey towards a more interactive and smarter AI Assistant. Who knows what it’ll be able to help you with in the near future?

Ready to give it a go?

You’ll find the AI Assistant in the menu bar to the upper right of the screen under Help.

And if you’re looking for the written help texts, you’ll find them a bit more to the right under the question mark icon.

Customer request

Update percentages manually on the FORA appendix

We have modified the appendix Calculation year reconciliation FORA so that the percentages can be updated manually. Move the mouse pointer over the field and select Override amount from the menu that appears when you click on the menu icon.

Restore the original value by selecting Reset amount from the same menu.

New functionality

Additional/reduced depreciation of machinery and equipment - now also available for sole proprietorships!

We are talking about support for calculating the minimum taxable residual value for the depreciation of machinery and equipment and the maximum excess depreciation. Previously this was only available for limited companies, but is now also available for sole proprietorships in Visma Skatt & Bokslut Pro. You can find the calculation page under Basis for tax return - Sole proprietorship - Additional/reduced depreciation of machinery and equipment.

Basis for tax return for private individuals

Additional depreciation of machinery/equipment (Sole proprietorship)

Customer request

Change the order of the appendices

Until now, there has been no easy way to change the order of the appendices in the balance sheet reconciliation and the IS analysis. In the past, to get them in a certain order, you had to delete the appendices and then recreate them in the order you wanted. Now we have made it so that you can drag and drop them in the order you want them. Check it out here!

You can change the order of appendices in open periods. When you create new periods, the order will be the same in the new period.

New functionality

Forest account/forest damage account

We have added a new calculation appendix to make it super easy for

New functionality

The annual report in English!

Now there is finally support for creating your annual report in English. The feature is available for limited companies using K2 and for financial years ending in 2023 and later.

You create it as usual in Swedish, switch language in the program, translate the texts you have added and you're done. Easy peasy, just check it out here!

Even if you use an English version of the annual report for information purposes, it is always the Swedish version that applies and must be submitted to Bolagsverket.

New functionality

Two new reconciliation appendices for tax adjustments

We have added the appendices Non-deductible recorded costs and Non-taxable recorded revenue under Year-end closing - Reconciliation BS. The appendices are created automatically when you select an option under Profit/loss planning when there are filled in values for the linked accounts under Tax Calculation.

Legal update

New rules in the annual report for housing cooperative associations

The requirements for what needs to be reported in the annual report for housing cooperative associations have changed and we have adapted the program to Bokföringsnämnden's updated guidance. The following is updated:

-

Under Multi-Year review, there is now a field for Disclosure in case of loss. This should be used when the housing association reports a negative result for the financial year. The association must then disclose this loss in the management report.

There is now also a requirement for certain key figures to be included in the annual report for housing cooperative associations. Therefore, two new KPIs are now available. These can also be found under Multi-year review:

- Indebtedness per square metre of rented cooperative apartment

- Share of annual fees in total operating income %.

Customer request

- display a text instead of a date when signing digitally

We have received requests not to show a date when the annual report and the minutes of the annual general meeting are signed digitally. Instead, the text Date is indicated by the digital signature will be displayed. The same applies to the auditor's signature. In this case, the text On the date indicated by my (our) digital signature is displayed instead of the date.

The texts replace the date when the annual report is sent for signing via Visma Sign. You can preview this with the Preview button on the Digital sign page.

Improvement

We have moved the Profit/loss planning!

We have received feedback that it can sometimes be difficult to find the profit/loss planning. So we decided to make it a little easier!

Nowadays you can find Profit/loss planning directly under Tax calculation. Check it out here!

Legal update

Support for taxation period 2024 P1

The program now supports period 2024 P1 for limited companies

The tax forms INK2, N3B, N4, N7, N8 and N9 look exactly the same as the forms for the previous periods, except for the bar codes.

Skatteverket will not open the submission service until 25 April 2024.

Customer request

K10 for partners!

Fantastic news! We have now added support for creating the K10 tax form for the company's partners/shareholders directly from the limited company in Visma Skatt & Bokslut Pro. After all necessary information has been entered on the appendix, the K10 tax form will be available from Tax forms. From the Submission page, the tax form can be generated either as a SRU or a PDF file that can be attached to the personal tax return.

K10 for partners is only available for limited companies when working in Visma Skatt & Bokslut Pro as a company, not as an accounting office.

If you use Visma Skatt & Bokslut Pro via Visma Advisor, you can already create a partner's tax return with the customer type Private person.

Improvement

Taxation value of real estate when calculating the interest distribution and expansion fund

When calculating the capital base for interest distribution and expansion fund in a sole proprietorship, you as a owner need to calculate the taxable value of the real estate.

Using the new calculation appendix Taxation value of real estate, you can now calculate the value of each individual property. The appendix handles both the main rule and the alternative rule.

Your ownership share is then transferred when calculating the capital base for interest distribution and the expansion fund.

2023

Improvement

Print check results from report center

An important improvement related to quality and documentation. Now you can print the check results from your auto checks! This is especially important when you need to document and archive the work you have done for your customers according the industry standard Reko/Rex.

You can select to print Check results marked as done or Check results with comments. For both report variants you can select standard or detailed view.

Customer request

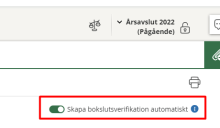

Automatic creation of system journal entry for taxes and fees is now optional

As you might know, we have a function that automatically creates a system journal entry that rebooks all taxes and fees against against the main account for total tax liabilities/claims. This is very useful for many, but we have received requests to make this optional. So now, the system journal entry can be deactivated with the Create closing entry automatically toggle on the appendix for Summary of the year's tax liability/claim.

Once the toggle is de-activated, any created system journal entry will be deleted and all amounts will be re-added to each account.

New functionality

Now possible to change regulation from K2 to K3 !

How hard can it be? At least not too hard, because we just did it! Now it's possible to change regulation from K2 to K3 for periods in 2023 and later. The regulation will change for ongoing and not started periods. (If you still have an ongoing period for 2022, you'll need to lock that before you can change regulation.) Checklists, financial statements and annual report will be updated according to K3.

New functionality

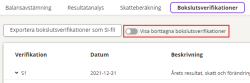

Submit N forms to Skatteverket via API

Now, you can submit the N-forms (N3B, N4, N7, N8, and N9) together with the INK2 to Skatteverket via their API. This is an addition to our existing support for the INK2 forms (INK2, INK2R, and INK2S).

With this enhancement, all tax forms for limited companies, economic assiciations and housing cooperative associations can now be smoothly and automatically submitted when you select the method Automatic transfer of files via Skatteverket's API.

New functionality

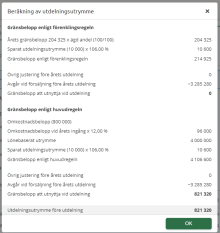

Show calculation of the scope of dividend for small companies

In tax appendix K10

The new link Show calculations - scope of dividend provides a detailed description of how the scope of dividends has been calculated. It shows the comparison between the main rule and the simplification rule and automatically selects the best rule.

K10 - Qualified shares in close companies

Customer request

Comments in tax forms and annual report!

Comments - a very useful and popular feature that you can use for communication, documentation or as reminders.

Example:

If you are using Visma Skatt & Bokslut Pro via Visma Advisor, you can tag the comments with To customer and then choose to include these in your reports from Report center when communicating with your customers.

This functionality has always been available in Reconciliation BS and Analysis IS, but now we have added them also in in Tax forms and in .

Improvement

Drill-down - open account analysis in a new window

When you drill down on an account, the Account analysis will now open in a new browser window. This makes it possible to have one or several account analysis windows open at the same time and still continue to work in the program. You can move the window around, even to a second screen. The account analysis is available in Reconciliation BS, Anlysis IS, main appendix, VAT & Fees, Financial statements and some checks in transaction analysis.

When the main window is closed, all sub-windows will be closed as well.

New functionality

Tax planning 2024 for partners in close companies

Last year we presented a brand new module for those who need to do tax planning for private individuals who are partners in close companies. The calculation part can be used to calculate salary based scope, salary requirements and dividends in close companies.

It is now time to calculate the salary requirement in the last part of 2023 in order to be able to utilise the salary based scope next year 2024. The tax planning for 2024 opens on 1 October 2023 and is available to private individuals. It is separated from the other declaration and can therefore be used completely independently.

If you used tax planning for 2023, the relevant data will be transferred to tax planning 2024 when you click the button Copy tax planning from previous year.

Legal update

An updated annual report template (taxonomy) for economic associations and housing cooperative associations

The annual report template for economic association and housing cooperative association for years ending in september 2023 or later has been updated and the following notes have beed added:

-

Övriga rörelseintäkter

-

Ersättningar till revisorer

-

Övriga rörelsekostnader

-

Upplupna kostnader och förutbetalda intäkter

For housing cooperative associations, we have added the new mandatory KPIs in the multi-year review (flerårsöversikten) and the cash flow statement (kassaflödesanalys) is also added automatically.

When we were at it, we also enabled the cash flow statement as an optional document for Limited companies K2 and Economic associations. You'll find them under Add.

Legal update

Support for taxation period 2023-P4

In the year-end, we now support all financial/calendar years until 2023-12-31. The tax forms have been updated with the current forms for taxation period 2023-P4.

New tax regulations for 2023 - Physical persons

-

The age in the pension system is raised from 65 to 66 years old.

-

The earned income tax credit is strengthened for people aged 65 and over.

-

Enhanced tax reduction for the installation of solar panels.

-

The tax calculations for the year 2023 have been updated.

New functionality

Checklists, check! Templates, check!

Checklists are a crucial part of the quality process as they offer an effective means of streamlining and communicating what needs to be done and what has been accomplished. With our new feature, you who work in an accounting office, can create and manage templates for checklists! For example, you can save a set of checklists as a template to be used for multiple clients, saving a significant amount of time as you won't have to set up the checklists individually for each of your clients.

You find and manage the templates under Administration - Template for checklists.

Improvement

Better display of errors and warnings when importing from SIE file

Sometimes everything just doesn't work as expected. But now, you will at least see a list of all errors and warnings that occured when you imported from a SIE file.

When there are errors in the import file, an error icon will be displayed which you simply click to view a list of all errors and warnings. Redo the import when the errors have been fixed and you're good to go!

SIE file is one of three possible data sources in Visma Skatt & Bokslut Pro. You can also use Manual entry or Visma eEkonomi.

Improvement

Search in our Help Centre - directly from the program!

With the new search field, placed in the top menu of the program, you can now directly search for relevant help articles, FAQs, movies or forum posts.

Customer request

Create reports with or without account information

From Report center, we have now added the possibility to print the balance sheet and and income statement with or without the account information included. You select which information you want to include with the Filter button  .

.

Improvement

Notifications!

Now, we are introducing notifications, a way to see what's going on in the background as well as other important events in the program. From start, the program will automatically display notifications when the following happens:

-

When a provision/resolution is selected from Tax calculation - Tax adjustments - Additional/reduced depreciation of machinery and equipment (Limited companies and Economic associations).

-

When a selection is made in Tax calculation - Profit/loss planning (Limited companies and Economic associations).

-

When the appendix Equity specification is created from Reconciliation - Appendices - Equity (Sole proprietorships).

-

When a period could not be automatically locked in Visma eEkonomi.

We're just getting started, and as we continue, we'll be adding more and more notifications.

Improvement

Same awesome program - with a new attitude!

Visma Skatt & Bokslut Pro has gotten a makeover and been painted in our new wonderful colours - coral, vanilla, and purple. We're only changing colour and shape, so except for that, it's business as usual!

The new look's in line with our new brand identity. We want the joy and energy that characterise our business culture to truly be felt and seen! So let's go - our journey has just begun!

Legal update

Support for taxation period 2023 P3

Visma Skatt & Bokslut Pro now provides support for the taxation period 2023 P3 for limited companies, economic associations and housing cooperative associations. This means that you already are able to close all financial years up til 2023-08-31.

The tax forms INK2, N3B, N4, N7, N8 and N9 look exactly the same as the forms for the previous periods, except for the bar codes.

Customer request

Closing entries from Visma Skatt & Bokslut Pro as a separate journal series in Visma eEkonomi

With a quick setting in Visma eEkonomi, you can now make sure that the exported closing entries from Visma Skatt & Bokslut Pro are bookkept in a separate journal series.

You do this setting in Visma eEkonomi, under Settings - Company settings - Accounting settings - Journal series - Closing entries. This can make life a lot more easy for many, we hope!

Improvement

Auditor notification when the annual report is submitted

Just to let you know, when you submit your annual report digitally, you can now add an email address (or a few) to let the auditor know that it's been submitted to Bolagsverket.

Improvement

Let us present a list of all appendices!

Reconciliation with appendices is a good way of keeping high quality in your work and with our built-in appendices, you can save lots of work! To make sure you work in the best way possible, we've just added a complete list of all appendices in the program. For every appendix, you can see it's recommended usage, how it's copied between periods, any built-in automation and what accounts are connected to it. The same information is also available when you have an appendix open and click the help icon.

Customer request

More flexibility with page breaks in the annual report

We have received feedback from some of our users requesting more flexibility with page breaks, particularly for situations where the signatures need to be placed together with the notes in the annual report. We hear you loud and clear! Now, you can simply deselect the option Print signatures on a separate page in the annual report to achieve this.

New functionality

What's up? The Event log can answer!

Introducing the Event log - a convenient feature that collects and displays important events in the program in one place! The interface displays all of your events in chronological order and you can quickly filter events by type or date range, making it easy to find the information you need. It provides relevant details such as timestamp, description, source, user and relevant period.

Legal update

Support for taxation period 2023 P2

The program now supports period 2023 P2

The tax forms INK2, N3B, N4, N7, N8 and N9 look exactly the same as the forms for the previous periods, except for the bar codes.

Customer request

Deleted closing entries are now hidden

A small but highly requested feature. Now, by default, the deleted closing entries are hidden in Year-end closing - Closing entries. But don't worry. You can display them again by using the Show deleted closing entries toggle.

Customer request

Let the program calculate the standard deduction

Via Own adjustment - Calulate exactly, you have the option to let the program calculate the standard deduction for business income so that it corresponds to the final social contributions. This can be useful, for example when a business is closing down and does not want to have to do any reconciliations in the coming years.

New functionality

New appendix - K15A - Divestment in trading partnership

We have now added the tax appendix K15A - Divestment in trading partnership. The appendix is used when you sell shares in a trading company and it helps you to calculate the taxable profit or deduction for the loss.

You'll find it from Year-End closing -

New functionality

Submit tax return automatically via Skatteverket's API

We are happy to inform you that we now support automatic submission of tax return via Skatteverket's API. By using this functionality, you can say goodbye to printing or download and transfer of files. The new submission method automatically sends all INK2 tax forms (INK2, INK2R, INK2S) to your personal space at Skatteverket. Note that you still need to sign them, once they have been transferred.

This functionality is available for limited companies and for financial years ending after 2022-08-31.

Customer request

Display only private income in tax computation

We have added the possibility to display the tax computation without any business income. With this setting enabled, the Tax computation and Tax arrears/refund pages will be displayed without any business income which makes it easier to compare the pre-printed information on the uploaded INK1 from Skatteverket with the information in the program.

New functionality

New appendix - T2 - Earned income - income from hobby et c

We have now added the tax appendix T2 - Earned income - income from hobby et c. It should be used if you have had income from hobby activities, which refers to income-generating activities of a lasting or occasional nature that are not business activities.

Examples of hobby activities include handicrafts, gardening, animal breeding, equestrian sports, boat rental, beekeeping, and cultural activities.

You'll find it from Year-End closing -

New functionality

New appendix - K11 - Investor deduction

We have now added the tax appendix K11 - Investor deduction. The appendix is used for requesting tax deduction for investments in smaller companies.

You'll find it from Year-End closing -

New functionality

You like notes? We too!

In connection with the update of the annual report to the latest version, some notes were added for limited companies that use the K2 regulation. These new notes are:

-

Övriga rörelseintäkter

-

Ersättningar till revisorer

-

Övriga rörelsekostnader

-

Checkräkningskredit

-

Upplupna kostnader och förutbetalda intäkter

The new notes are available for financial years ending in 2023.

New functionality

New appendix for Dormant input VAT

When Dormant input VAT is used in Visma eEkonomi and an import is made to Visma Skatt & Bokslut Pro, a reconciliation appendix will be automatically created. The appendix is placed under Other liabilities, connected to account 2648. Offset accounts are 2640, 2641, 2646 or 2649, depending on what was used in Visma eEkonomi.

New functionality

New appendix - T1 - Earned income - income with social contributions

We have now added the tax appendix T1 - Earned income - income with social contributions. It is used for declaring income from services for which you have to pay social contribution fees and other taxes.

You'll find it from Year-End closing -

New functionality

Support for cost centres, cost centre items and projects

When working with dimensions such as cost centres and projects in your accounting, we have now added support for this in Visma Skatt & Bokslut Pro.

When you import accounting data from SIE file or from Visma eEkonomi that includes cost centers, cost centre items or projects, they will be displayed in all relevant places in the program when expanding related accounts. It is also possible to use cost centres and projects when creating closing entries.

-

The dimensions and their related objects are stored per financial year.

-

All dimensions and objects are imported, but only the first 4 dimensions will be visible.

Customer request

Ahh, some flexibility added in the annual report!

We have added possibility to alter edit headers and rows in notes, balance sheets and income statements for the year-end closing. Since before, the functionality has been available for companies using the K3 regulation, but is now enabled for limited companies using K2.

The feature is available for financial years ending 2022-09-01 or later.

Legal update

Support for taxation period 2023 P1

The program now supports period 2023 P1

The tax forms INK2, N3B, N4, N7, N8 and N9 look exactly the same as the forms for the previous periods, except for the bar codes.

The documents in the annual report have also been updated according to Bolagsverket's latest version of the taxonomy for digital submission.

Improvement

Extend a financial year with more than one month and possibility to change the start date

A small, but important improvement! Now, a financial year can be extended with more than one month! We have also made it possible to extend the financial year by changing its start date.

Improvement

More improvements in the appendix for debited preliminary tax

Last November, we made it possible to auto-fill an entered value to the coming months in the Debited preliminary tax appendix. Now, we have also added support for more broken financial years. The appendix will be adjusted to display the correct months and will transfer the correct values to the Summary of the year's tax liabilitiy/claim appendix.

Improvement

We call it "best digital practice"

We work very hard to make sure that you have a good program that makes you as efficient as possible. If you want to know how we think you should use the program in the best way - take a look at the section Getting started with Skatt & Bokslut. It is for both you who are a new user and for you who have been working for a while. Maybe you'll find a little tip that you didn't know about before!

Let us know what you think - hit the thumbs up at the bottom of the page and feel free to leave a comment!

New functionality

Finally - support for economic associations and housing cooperative associations!

We are proud to inform you that we now have built-in support for economic associations and housing cooperative associations. All regulations, annual report documentation, tax calculation and tax forms are adapted so that you easily can do your period or year reconciliation, tax calculation and annual report. You select the company type in the start guide. The new company types are available for financial years ending 2022-12-31 or later.

Tax calculation for limited companies and economic associations